The Essential Importance of Risk Management in Protecting Business Assets

Discovering the Relevance of Risk Management for Effective Decision-Making Approaches

In the detailed globe of company, Risk Management becomes an essential consider the decision-making procedure. The ability to identify potential hazards and chances, and strategize appropriately, can mean the difference between success and failure. With devices such as SWOT and PESTEL, organizations are outfitted to make enlightened selections, cultivating strength and adaptability in an ever-changing setting. Wondering just how this works? Let's unpack the characteristics additionally.

Comprehending the Idea of Risk Management

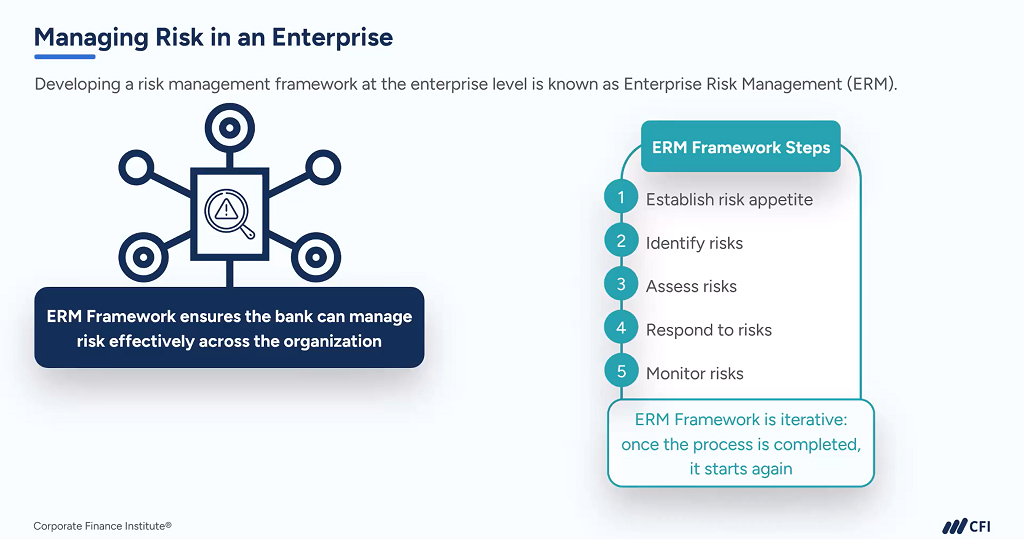

Risk Management, a crucial element in decision-making, is usually misunderstood or oversimplified. Typically, it describes the recognition, examination, and prioritization of dangers to decrease, keep an eye on, and control the possibility or effect of regrettable events. It's not merely about protecting against adverse results, however likewise about recognizing potential opportunities. Risk Management includes disciplined and organized strategies, making use of information and insightful assessments. It calls for a thorough understanding of the company's context, goals, and the potential threats that can combat them. From economic unpredictabilities, lawful obligations, tactical Management mistakes, to accidents and all-natural catastrophes, it addresses numerous dangers. Importantly, effective Risk Management is not stationary; it's a constant, progressive process that evolves with transforming scenarios.

The Function of Risk Management in Decision-Making Processes

In the realm of strategic preparation and business procedures, Risk Management plays an essential duty in decision-making procedures. Risk Management thus becomes a vital tool in decision-making, aiding leaders to make informed choices based on an extensive understanding of the threats involved. Risk Management offers as an essential part in the decision-making processes of any type of organization.

Exactly How Risk Management Enhances Strategic Preparation

In the context of critical planning, Risk Management plays a pivotal function. Initiating with the recognition of prospective risks, it additionally includes the implementation of Risk mitigation procedures. The role of Risk Management is vibrant but not fixed, as it demands constant surveillance and adjusting of techniques.

Identifying Potential Threats

Carrying Out Risk Mitigation

Risk mitigation strategies can range from Risk evasion, Risk transfer, to run the risk of reduction. Each strategy must be tailored to the certain Risk, considering its prospective impact and the organization's Risk tolerance. Efficient Risk mitigation calls for a deep understanding of the Risk landscape and the possible impact of each Risk.

Surveillance and Adjusting Methods

Though Risk mitigation is a critical action in strategic planning, continual surveillance and adjustment of these strategies is equally essential. It also offers a chance to evaluate the success of the Risk Management steps, allowing changes to be made where needed, additional enhancing critical preparation. Monitoring and adjusting Risk web Management approaches is an essential element for improving a company's durability and strategic preparation.

Instance Researches: Successful Risk Management and Decision-Making

In the world of organization and financing, effective Risk Management and decision-making frequently offer as the pillars of thriving business. These instances highlight the value of astute Risk Management in decision-making procedures. These cases highlight the critical function of Risk Management in tactical decision-making.

Devices and Techniques for Efficient Risk Management

Browsing the intricate labyrinth of Risk Management needs the right set of strategies and tools. These tools, such as Risk signs up and heat maps, aid in identifying and examining potential dangers. Techniques consist of both quantitative techniques, like level of sensitivity evaluation, and qualitative approaches, such as SWOT analysis. These help in more tips here focusing on risks based on their possible impact and possibility. Risk feedback methods, a key part of Risk Management, involve approving, preventing, moving, or mitigating threats. Monitoring and regulating dangers, via regular audits and evaluations, make certain that the techniques stay effective. With these methods and tools, decision-makers can navigate the complicated landscape of Risk Management, thus assisting in educated and reliable decision-making.

Future Patterns in Risk Management and Decision-Making Strategies

As we discover the huge landscape of Risk Management, it ends up being obvious that the tools and strategies utilized today will continue to advance. Future patterns point in the direction of a raised dependence on technology, with expert system and artificial intelligence playing substantial roles. These modern technologies will certainly enable companies to anticipate potential threats with greater precision and make even more informed choices. In addition, there will be a growing focus on durability, not just in managing dangers yet likewise in recovering from adverse situations. Last but not least, the idea of Risk society, where every member of an organization realizes and included in Risk Management, will acquire more prestige. These trends proclaim a more aggressive and inclusive strategy towards Risk Management and decision-making.

Verdict

Risk Management therefore becomes an important tool in decision-making, aiding leaders to make educated choices based on a comprehensive understanding of the threats included. Risk reduction techniques can range from Risk avoidance, Risk transfer, to risk decrease (importance of risk management). Efficient Risk mitigation calls for a deep understanding of the Risk landscape and the potential effect of each Risk. Risk response methods, an essential component of Risk Management, entail accepting, staying clear of, transferring, or mitigating threats. The idea of Risk culture, where every participant of an organization is mindful and involved in Risk Management, will gain much more prestige